In terms of the real estate market, this summer was definitely a bit different than the last two, in large part because the interest rates went up by 2x since last year, and that’s had quite an impact (to no one’s surprise) on the market as a whole.

Where will it be this fall?

Here’s a little breakdown of where we are as we head into the fall market. As always, if you (or anyone you know) are thinking of buying or selling, or you simply have questions, please don’t hesitate to reach out. I’d love to help!

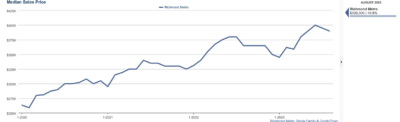

While the average sales price of a home in the area has dropped a bit from its high of $399,990 (June ’23) to $390,000, it’s by no means a large drop and tracks pretty well with seasonal trends. August always dips a little in numbers simply because the heat, vacations, back to school, etc., generally cause the market to take a bit of a breath before “back to business” in the fall.

That average sales price number is up from $380,000 this time last year, so if the national media has told you things are cooling in some areas, we are not one of them that is. One bright spot in the housing affordability stress is that while our prices have gone up, they do not (generally speaking) appreciate the insane rates that some parts of the country has, and that’s definitely welcome if you’re buying.

We’re definitely still feeling the inventory shortage, with closed sales for August totaling 1140, vs last year’s 1507. We still do not have enough homes to sell, despite the interest rate increases sidelining some of the people who would have liked to buy.

As a result of this inventory crunch, we’re still seeing homes sell for 102.3% of the list price, generally due to multiple offer situations. This is down only ever so slightly from last August when it was 102.5%. Sort of crazy when you do consider the 100% increase in rates since then. In fact, neither the days on the market until a home sells nor the number of showings until a contract has been received, has changed at all since last year.

So when will this get better? It’s going to get better, right??

The good news is yes, it will. The bad news? We’re not sure when, or how much. Given that we were already in an inventory shortage prior to the rate increases, that’s gotten considerably worse. According to Redfin data, 66% of homeowners in Virginia have rates below 4% (and 28% have rates under 3%). That means that for many of them, they’d nearly double their rate by selling and buying another home. There are always reasons that will make people need or want to do this, but the casual “I’d just like a new home,” sellers/buyers are in most cases sitting this market out.

If you’re thinking of buying, you may be tempted to wait until rates drop, and I totally understand. Just don’t think that prices will drop at the same time. With the inventory shortage likely to continue into the foreseeable future (most experts say that nationwide it may take a decade for our housing shortage to catch up), prices are likely to continue to go up. If rates drop a good bit, the prices are likely to go up even more. (That’s just Econ 101- low supply will push demand higher).

According to many experts (those experts again!), including Fannie Mae, rates are likely to drop to around 6% or so in 2024, but probably not until the second quarter. They’re very unlikely to drop this year, though, so the market this fall is going to be… well, interesting.

Historically, rates hover around 5-6% and that’s certainly likely again, but please please please don’t continue paying rent, and waiting for those 3% rates again. They will most likely never return.

If you have questions about any aspect of the real estate market, I’m happy to help. Just drop a comment, send me a message, or give me a call!

*All numbers and stats here are from info found in the Central Virginia Regional MLS, and based on numbers for the Richmond Metro area.