HomeBuying

Keep on top with latest and exclusive updates from our blog on the Los Angeles real estate world. Cindy Bennett Real Estate posts about tips and trends for buyers, sellers, and investors every week. Whether it be about staging your property or a snapshot of the market, this is your one stop shop.

What's going on in the market as the leaves start to fall? Anecdotally, we're definitely seeing things get just a bit slower. Listings are taking a little more time to sell, and there just aren't quite as many buyers (read:competition) out there. Homes are still selling for nearly 100% (and sometimes more than) asking price, though, so make sure you have all your data and a great agent on your team when you're ready to start looking or when you're thinking of selling. For more detailed info, see below, or as always, call me! Median List Price In September, the median list price for homes in the Richmond metro area stood at $429,970 — down ~2.8% year-over-year. This softening suggests that sellers are beginning to feel a little pressure as buyer expectations strengthen and interest rates shift. List to Sales Price Ratio Homes are still selling close to asking price, but with the exception of some areas and very specific (read: outstandingly prepared) homes, the sale-to-list price ratio is about 98.9%. That means that on average, homes sell for roughly 1.1% below their original asking price. This means pricing right is super important right now. Pay close attention to where the market is when you list, not where it was a few months ago. Mortgage Rates (Early October Snapshot) As of early October 2025: 30-year fixed: ~6.30% 15-year fixed: ~5.53% Rates are lower than they've been for a while, but still higher than a lot of people feel great about, they're still limiting what people are wanting to spend. (And if they're spending, they don't want a laundry list of "things to do.") Average Days on Market Properties in general are spending an average of 32 days on the market before going under contract. While that's not crazy slow, there’s still enough activity that pricing, presentation, and timing matter. What This Means for Sellers & Buyers For Sellers Price thoughtfully — going too high can scare off buyers in this environment. Presentation is essential. Professional staging, strong photography, and minimal negotiation buffers go a long way. Be ready for some pushback. Buyers will negotiate when they see room for it — be realistic about offers and requests for concessions (like closing costs and/or repair items.) For Buyers Offers just below asking may indeed cut it, but not on every house. You may be able to save a little, but you definitely still need a strategy. Watch new listings closely. Some homes are definitely sitting, but the right home in the right neighborhood may move fast. What’s Next? Watch These Metrics To stay ahead, keep an eye on: Inventory / New Listings — a jump here can shift leverage toward buyers. Days on Market — rising days on market often signals buyer fatigue, but with so much uncertainty, buyers are generally being more thoughtful and discriminating about what they buy. Interest Rate Movements — even small rate changes can influence purchase power and buyer urgency. Absorption Rate — how fast homes are moving relative to available inventory. As I always mention, a "balanced market" is 6 months of inventory. While October appears to be leaning a bit more toward sellers, the official numbers are still holding where we've been the past few months, at 2.10 months of inventory. Final Thoughts In September 2025, Richmond’s housing market remains relatively stable, though slightly softer compared to last year. Buyers and sellers alike should have realistic expectations, stay nimble, and work with knowledgeable agents (like me, obviously) who can read the subtle shifts. If you want more detailed information, as always, reach out to me and let's talk!

Read more

If you’ve been watching the Richmond market, here’s the quick scoop: more homes are FINALLY hitting the market, prices are still edging up, and mortgage rates just dipped to their lowest point in nearly a year. Translation? In the Richmond area, it’s still a seller’s market, but buyers have a little more breathing room than they did this spring. The Big Picture More homes for sale: Listings are up compared to last year—especially condos and townhomes. That means more options for buyers. Prices are still rising (slowly): The median single-family home price is about $433,000, up 3% from last year. Homes are still moving fast: Most single-family homes sell in about 3 weeks, and sellers are still getting nearly full asking price. (And yes, we're still seeing multiple offer situations on occasion.) Rates are helping buyers: The average 30-year mortgage rate just dropped to 6.35%, giving buyers a little more affordability. What Buyers Should Know More choices: Inventory is improving, especially in townhomes and condos. (Hooray!) Better payments: Lower rates mean monthly payments are slightly easier to swallow than midsummer. Smart offers win: The best homes still draw competition—being prepared with financing and a solid strategy makes you stand out. What Sellers Should Know Price it right: Homes that hit the market at the correct price are selling quickly and close to asking. Prep matters more than ever: Clean, staged, and well-marketed homes get top dollar. Condo and townhome sellers: Expect a bit more competition—presentation and pricing are key. Quick Look by Area Richmond City: Median price of around $410,000, up ~8%. Most city neighborhoods are still strong. Henrico: Median $415,000, prices are nearly flat year-over-year. Updated homes in west end zip codes remain popular. Chesterfield: Median $430,000, up ~2%. Newer neighborhoods are steady and attract buyers for value. Hanover: Median price about $496,000, slightly down. Larger lots and unique properties are driving the market here. Bottom Line Buyers: You finally have a bit more room to negotiate and slightly better rates—let’s find you the right home before the holidays. Sellers: The market is still in your favor, but buyers are much more picky than they've been for the last few years. Pricing smart and prepping well are the difference between “Just Listed” and “Just Sold.” Thinking about making a move this fall? Let’s talk about your neighborhood and your goals—I’ll bring the data and a strategy to get you there.

Read more

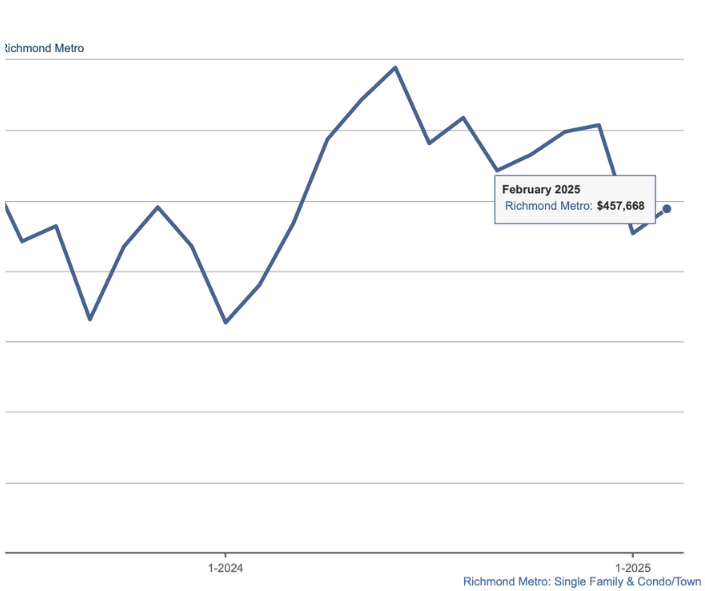

Market updates are a bit like tapping the mic with an "is this thing on?" People say they want them, but I always wonder how much they actually get read. So if you're reading this, please let me know! March 20 heralds the first day of Spring, and I for one couldn't be more excited. But if we're talking about the market, it really has felt like spring for a while now! Here's a little bit of data to give you a snapshot of the overall market in the Richmond Metro. The average sales price in the Richmond Metro in February was $476,907. That's a bit lower than the prices in December, but a bounce back from a lower January price of $469,296, and it looks like it's back on the upward trend. If you've followed me for a little bit, you've probably heard me talk about the months supply, and how at a balanced market, we'd have about 6 months of inventory. It's been a while since we've been there, and for the last 2 months, we're holding strong at 1.3 months of inventory. A good distance from balance. This data tracks in what I've seen in the last couple of weeks, as well. Lower inventory means you may need to compete to get that home you love, because there are simply more buyers than there are great houses. Sometimes that means you have to pay more, but sometimes it just means having as much info as you need to craft an offer that will be the most appealing to the seller. Every situation is a little different, so there really is no one size all formula here. If you're selling, lower inventory means you have more eyeballs on your house, usually more showings, and (in many cases) more offers. Yes. You only need one offer, but the nice thing about multiple offers for you as a seller is that when people are competing, you're less likely to have to deal with a lot of inspection issues, you usually get more money, and you are more in the driver's seat with the entire transaction. We're seeing lots of multiple offer situations, although the market is quite price sensitive. What does that mean? You can't just thrown any home on the market, at any price, and think it's going to sell. The homes that are not "market ready" are still sitting on the market, and generally not getting multiple offers. Having your home ready makes a huge difference, as does pricing it well. Price it too high, and it just might sit there as well. There are definitely neighborhoods and areas that are more popular, and others where things are not quite as "wild." Knowing which one you're in, or looking in, can make a huge difference. I'd love to talk to you about the area you're in (or want to be in) and help you determine the best strategy to get you where you want to be. What are your market questions? Reach out!

Read more

Although it's nonstop snowing as I type this, the spring market has already begun. Yes, rates are still not great, and there is still not a ton of inventory, but in any type of market, people are going to want to, and more than that, need to, move, and it looks like the times of fence sitting to see how rates are is really about over. So if you're buying or selling, here's some great info to know, as we are finishing up (I hope!) winter, and kicking off spring! Prices in the Metro Richmond area have dropped since the beginning of the year, a good bit, in fact. In December, our average sales price was $411,635, and for January, that average sales priced dropped to $394,900. New listings have spiked from December's 793, up to 1171 for January. By my calculations, as I assess February up until today (2/19) we have approximately 893 new to market listings for the month already, and we've got about 10 days to go. This is all good news for buyers getting into the market. More inventory means lower prices, and less competition, which is definitely welcome, when rates are where they are. Just as good news- while we are still seeing some competitive situations, there are generally fewer than there have been (think 4-10, rather than 20-40, in most cases) and we are once again seeing not only inspections, but it some cases, we're even some seller concessions at closing! What if you're selling? No bad news there either. As I mentioned before, we are still seeing multiple offers in many cases. The median list to sale price ratio in January was still at 100%. The average was still a bit over that. Is that a guarantee? Of course not. What I can tell you is that the more you do to get your home ready to sell (fixing/repairing), cleaning, decluttering, landscaping, etc., the better off you will be when it comes to list. When it comes to pricing, and those little things that make your home stand out from the rest, they can make a huge difference in the speed of sale, and the number and quality of those offers. If you've got questions about selling your home or thinking of starting a home search, I'd love to talk to you!

Read more

If you've been thinking of buying or selling a home, or you watch, read or listen to the news at all, you may have heard changes are coming to our industry this month. In fact, these changes take effect nationwide on 8/17, but will start to be put in place here in Central Virginia 8/6. So what are the changes, and how might they affect you? The who, what, and why... The biggest change is the "decoupling" of commissions. What the heck does that mean, anyway? For decades, real estate commissions have worked this way: An agent would list a home, negotiating and setting the commission with the seller, and a portion (usually half) of that commission would be paid from that listing brokerage to the buyers' agent and their brokerage. This year, a class action lawsuit filed against the National Association of Realtors and a few larger players in the industry, was settled. The suit was brought by some home sellers who felt that they had not had any choice to negotiate or change what they were paying to the agent who brought the buyer for their home. As a major part of this settlement, the National Association of Realtors agreed to change the way buyers' agent commissions were paid- "decoupling" them from the commissions negotiated by the listing agent and the seller. Forever (at least during the 21 years I've been in real estate), agents have been able to see the buyer's agent commission that is being offered on a particular home in the MLS (multiple listing service.) Effective 8/6 here in Central Virginia, that will no longer be the case. It's not that commission won't be offered. In some cases it will, and in some, it may not. It just cannot be visible in the MLS anymore, effective August 6, 2024. Now, having said all of that (which I hope makes sense) Here's how it might affect you: Before you are able to view a single home, you will need to sign a buyer brokerage agreement with an agent. This is a change for many people. While buyer brokerage agreements have been "a thing" in Virginia for years, to say that it was a loosely enforced rule is an understatement. This agreement lays out what the agent is going to do, what you are obligated to do, and hopefully, brings some clarity to how and what we get paid in the process of your home purchase. This fee is, and always has been, negotiable, and there are a variety of options available in the market. It also states quite clearly that you, the buyer, are committing to pay this agent you're retaining at the end of the transaction. Somehow, and in some way. HUH? When you decide you want to purchase a home, you should have a "buyer's consultation" with the agent you are thinking of working with. You may even interview more than one. That agent(s) should review not only the buyer brokerage agreement, but also how they work, what they're going to do for you, and give you clarity on what they charge for their services. This is not new. (For me, at least.) Here's the NEW part. Previously, as these agreements were only loosely enforced, and in many cases, signed only after you might be under contract, most buyers didn't understand that they were liable for that buyer's agent commission if the seller/listing broker was not paying it. It was also often written to read "buyer's agent accepts whatever is offered in MLS," so buyers' agents didn't always have to have those icky money conversations with their clients, because they could clearly see the commission on every house in MLS. So how is this NEW?? The new agreement does not have that option, as there will be no commission listed in MLS. The commission must be discussed and agreed upon before any home is shown. Because while commission has been "paid by the seller" for years, we all know the seller is not paying anyone anything until the buyer actually buys the home. So who's really paying? Yep. The buyer. (So yes, it seems like it's changed, but in many ways, for many people, it won't make much of a difference.) Agents will not be able to show preference (in theory, at least) to homes that are offering higher commission. I've never done this, but I'm sure it's done. Does this mean I'm going to have to pay my agent if I'm buying a home?? Maybe. In most, or at least many, cases, there will be all or some commission still offered by either the listing brokerage (as has always been the case) or the seller. This may be offered in the form of a straight payment of commission, or might be negotiated in the offer in the form of closing costs that you can use to pay your agent. In the event the seller is paying less than you've agreed upon with your agent, you will have the option to either make up the difference or ask the seller (in your offer) to pay more than they've initially stated, either directly, or to you through concessions (closing costs). If the news, etc, has led you to believe that if you are selling, you no longer have to pay a buyers' agent, that's both true and not true. The truth is, even before this, you could have offered as little as $1 to the buyers' agent, so technically, you never "had to" pay a buyers' agent. Is that a good idea? Well, It's probably not the best way to get the most people into your home, because IF people are working with a buyers' agent, which most still will be, they will have to pay their agent out of pocket if you are not. That means, if they don't have the cash to do so, they may have to pass on seeing your home. What if you don't have the money to pay your agent and the seller won't contribute/help?? Unfortunately, this will likely be a problem in some circumstances, and one of the concerns I have about the whole situation, especially for first time or low cash buyers. If a seller refuses to contribute, we can always ask them to increase the price to allow for the concessions in the contract to cover your buyer's agent, but if not, if you cannot pay your agent, you may need to find another house. (This is definitely one reason why most sellers will likely offer some compensation). "Okay, so if I want to get the best deal on a house, should I just go to the listing agent directly, and represent myself?" Not so fast. There are a couple of things to remember here. First, and perhaps most importantly, the listing agent represents the seller, first and foremost. They are hired to get the seller the best and highest offer, with the best terms, for the seller. They have no duty to you, other than to be honest (not lie) and at best, facilitate. It's also good to be aware that the agent has likely made an agreement with the seller that in the event someone comes in with no representation, they'll make more money. So your savings, or the idea that you can offer less to the seller because they're saving money, may not even be a real thing, and you will have had no representation. "But can't they do dual agency, and represent both of us?" Weeeelllll, they can. It's legal. (For now) But think about it- they're working for the people who want the most money, and the best terms for them, and now they're going to also work for the people who want to pay the least amount of money? Hmmmm. (Oh, don't forget, this is not free, either.) Here's the thing: as a dual agent, the agent usually makes more money, but they now can't advise you, the buyer, OR the seller. What?? If that sounds crazy to you, join the club. Seems like the agent in this scenario is working for no one so much as themselves, right? That's exactly why I don't like it, and why I have never done it. Just want the high points with no yakity yak? 1- Buyers will need to sign a buyer brokerage agreement before they view any home. 2- As commissions are "decoupled," you as a buyer may have to pay your buyer's agent, as the seller may not always offer concessions in the amount you've agreed on with your agent. Make sure you understand what you've agreed to. 3- Yes, you can go to open houses without having a sign an agreement. (That only comes when you have a real conversation about the property.) 4- Sellers will still be able to offer compensation to buyer brokers, and in many/most cases, they will. My take? This will be a confusing, and likely slightly rocky, time, but change is often where good things happen. When it all shakes out, I do think it will be good for everyone- more clarity, more education, and better service for consumers. What questions do you have? Let me know.

Read more

If you're thinking of buying a home, you're probably talking to different people, doing some research online, hearing different opinions, and maybe stressing out a little bit about, "What if I make the wrong decision?". Yes, this is a huge decision, but getting some clarity around what you want and what you don't want and what your concerns are, and yeah, talking to your agent about those concerns, can go a long way to helping you make sure you make the right decision when you're buying. Yahoo Finance did a little survey of some of the reasons that people have regret about the home that they bought over the past year and I'm going to go down the list and talk a little bit about each one.

Read more

All the things to know about what you see in the news about the real estate industry And wow. There has been a LOT of news out there lately. You’ve probably seen the headlines over the last week or so, about the “seismic” changes coming to the real estate industry. Lots of info out there feels an awful lot like clickbait, to say the least, and in most cases, it's quite confusing and misleading. Here’s a little recap of what’s happened, what’s happening, what’s (likely) to come, and most importantly, how it might affect you if you are thinking about buying or selling real estate. This is all facts, with my thoughts in italics... What's happened: Over the past few months, there have been a couple of class action lawsuits brought against the National Association of Realtors and some of the larger players in the real estate space. In short, a class of homeowners in Missouri allege that they had no idea that they had choices when listing their home, did not know they could negotiate, and felt that they paid inflated fees when listing and selling their homes. While the suits were going on for a while, the big news came in the last week, when the National Association of Realtors agreed to settle this case. IF the settlement is approved by the court, they've agreed to pay out $418m over the next four years, AND make some substantive changes to the way the system works, and the way agents are paid. The changes that will go into place, should they be approved: Compensation offered by sellers will no longer be visible in MLS. What this means: Up to now, commissions have been distributed this way- Sellers list their home with a listing agent for a fee (for the purposes of this exercise, we're going to use an imaginary number of 10%). FROM that fee, they agree to offer compensation to the buyer's agent. (In many cases, half, so in this scenario, from the 10% listing fee, each agent gets half at closing.) This compensation offered to the buyer's agent has always been visible in MLS, and as is to be expected, there are agents who have been accused of "steering," or taking buyers only to see homes that pay them well. This will go away to eliminate any real or perceived steering of clients. Buyers working with a buyer's agent will need to sign a contract with that agent prior to viewing any homes. This is really only a variation of what's going on now, and has from years. You should really always have a very good idea of how your agency relationship works- what your agent does for you, how they get paid, and who is paying them. Part of this is getting it all in writhing. This covers the agents, yes (because we can't and don't work for free), as well as the buyer, who better understands the buyer agency they're in. What these things mean and where I think the media has things a little twisted: There is lots of news out there saying that "The 6% Commission is Gone!" and while that is definitely attention grabbing, it's a bit more nuanced than that. First and foremost, commissions are now and have always been negotiable. Now, this doesn't mean that the agent you want, or the services that you know will fit your needs, will cost what you want to spend- but there are many, many options in the marketplace. I liken it to a little black dress- you can buy one at Walmart, Nordstrom, or Saks Fifth Avenue. They are all a little black dress, but they are definitely not the same price, nor the same quality. There may be a time and a place for each option, but they're not interchangeable. Our industry was definitely ripe for some change, so this will definitely bring about some interesting changes and business models. Sellers and listing agents will likely, in many cases at least, still offer buyers' agents commissions as part of the transaction. While there will need to be a contract in place between buyers' agents and buyer clients that states the buyer will pay the commission should none be offered, my expectation is that sellers who want to get the most qualified buyers in there homes will indeed still use this as a form of incentive. In the cases (and there will be some) where the sellers/listing agents are not offering any form of compensation for the buyers' agent, the buyer will have options on "how" to pay for their representation. It can be negotiated in the contract for purchase (basically asking the seller to "pay"), or the price can be bumped up just a bit to include it. As it must now be made clear to sellers that they do not NEED to offer compensation, one of my largest concerns is that there will be occasions where first time and/or inexperienced buyers will feel like they cannot afford buyers' representation, when in most cases, they can't afford not to. By going directly to the listing agent, they'll be working with the agent who represents the seller, and they'll have no one on their side. (And trust me, that is seldom good for the buyer, even with a very ethical agent.) Another expectation/concern I have as we navigate through these changes is that while the headlines make it seem as though there will be a big reduction in the price of houses, name me another circumstance where the cost of "goods" goes down and the price of the item to the consumer drops. In other words, I have every expectation that if the neighbor sold their home for $400,000 while paying commissions to both their listing agent and a buyers' agent, the "new" seller is not going to sell their home for less because they're not paying the buyers' agent compensation. They're going to want to list at the same price their neighbor did. I could go on. But in short, there will be lots to navigate over the next year or so. Please feel free to let me know if you have any questions. The headlines are confusing, so if you're stumped on what's going on, reach out. I'm happy to answer anything you might think of. Onward!

Read more

I may have mentioned before, back in the olden days before the mortgage crisis of 2007/2008, the appraisers were able to be chosen. So, maybe somebody had a specialty in the city of Richmond and that is the appraiser that everybody would call if they had a property in the city of Richmond, especially if it was a property that I don't know might be a little trickier to appraise, and the lender and or the agents were able to request a particular appraiser. That is no longer the case, because the appraisal companies, the appraisers themselves, work for the lender. The lenders have to have an unbiased opinion of the value. Somebody who is not necessarily chosen, they just get handed the name of that appraiser and when that happens, we do get a more unbiased opinion of value. But sometimes it can create a problem if an appraiser is not totally familiar with the nuances of a particular area or neighborhood. In most cases, it's fine because the data is what the data is right? But trickier appraisals can happen. And there are ways to deal with those too. So, follow along for my whole series on appraisals and get a little bit more information about what can happen, what the pitfalls are, why you want an appraisal or maybe you know that you're going to have an issue and you want to know what might happen and how to deal with those problems.

Read more

Let's talk about timing the markets. I think it's a thought that sounds really good in theory, but in practice, it's a little difficult. So obviously, we always want to sell high and buy low. I think that's kind of the idea that we all have when we are dealing with real estate. But think about the fact that that generally does not happen in the exact same market. So timing the market, I think, when you are buying not for investment, but for your primary residence, is almost impossible. Because to time the market well, you have to think about not only when you're going to buy, but when you're going to sell. And while that's easy to do or easy to think about in terms of stocks, or investments, it is a little more difficult when we're buying a home for maybe your family because if October turns into the month to sell, you have to then buy something else or have a place for your family to live. So if you're looking at buying a primary residence, I would suggest looking at that whole big picture and not worrying as much about timing the market because it will probably make more sense over time and less sense to try to target the exact buy date and sell date to make maximum profit when it's your primary residence. So let's save that for investments and for primary residence, we're going to look at it in a slightly different way. If you're thinking about buying or thinking about selling, I'd love to talk to you and help you put together a game plan that's going to give you that big picture to make it all make sense for you both for yourself your life, your lifestyle, your family and your finances.

Read more

It's January, and everybody's making their list of things that they want to accomplish in 2024 and I'm right there with you. But if one of the things that you want to do this year or hope to do this year is buy a home, one of the questions that you probably have is 2024 gonna be better to buy than 2023 was, because it was not that easy last year to buy a house, especially if it was your first home. So here are my predictions for what 2024 is going to look like if you are a homebuyer. We've already seen interest rates drop and that is fantastic because last year they inched up and inched up and inched up to a point where for a lot of people, it was just too expensive to buy a house. But we've already seen them come down and the Federal Reserve has already said that they're going to reduce rates a few times over the course of this year. So I think that we have some good predictions that rates are going to come down to a more attainable, not 3%, but a more attainable spot. So we are unlikely to see those 3%, sub 3%, rates anytime, possibly ever. So if you're waiting for rates to drop back to three, you're going to be waiting a really long time, most likely. And you probably don't want to do that if you're seriously thinking about buying. But as rates come down, it will be more attainable payment wise. But what I want you to keep in mind is if you've been waiting on the sidelines thinking maybe I'm gonna wait to buy a house, remember that right now we're in January, the market is tight with inventory, we still don't have a ton of homes out there and as rates go down, more buyers are going to be entering the market. So if you're thinking you'd like to buy this year, maybe you're thinking I want to buy in spring, you're thinking sometime this year I want to buy I'm going to wait until spring when more homes are on the market. Start looking now because there is less competition out there now in January and February then there will be trust me in March, April, May. So if you're thinking and you're able to buy now with the rates as they are, get out there now, start identifying what you like, what you don't like, and figure out when you can actually move forward because this year is shaping up to definitely have lower rates than last year. Maybe a little bit more inventory though it might be the same and we are gonna see a lot of competition. So get your head in the game. Give me a call. Let's chat. I'll put you in touch with a lender and let's make a game plan to get you in a home in 2024.

Read more