buying in rva

Keep on top with latest and exclusive updates from our blog on the Los Angeles real estate world. Cindy Bennett Real Estate posts about tips and trends for buyers, sellers, and investors every week. Whether it be about staging your property or a snapshot of the market, this is your one stop shop.

So you want to buy a house and you definitely want to have a home inspection, but how does that whole thing work? So for the last few years, I've been saying, we're in a weird market, and a lot of people have waived home inspections. We've seen different sorts of clauses for home inspections, but sometimes you just want to have a regular old full home inspection and you're able to do it with the contract that you have. So let's talk about that really basic, such is the home inspection process. What is a home inspection gonna do? Well, I always look at a home inspector as sort of like your general practitioner. Keep in mind that in most contracts, and in our basic boilerplate contract here in central Virginia, it's going to give you the ability as the buyer to have as many inspections as you want to pay for. But the default home inspection that most people think about is your general home inspection. So that means they're going to go in the crawlspace. They're going to check out the insulation. They're going to make sure the structure looks generally good. They're going to run your faucets, flush the toilets, look at the electrical panel, and test your outlets. All of those things that you're going to be using and living in the house all the time to make sure that they look generally good. So a couple of things to know. Make sure that if you have a question about something, the HVAC looks old, the roof looks old, or you're concerned about the crawlspace, point those things out to your inspector. I have never met an inspector who is not happy to take a closer look at something that you have a particular concern about and just give it an extra once over. I personally usually try to do the home inspections sooner in the timeframe so that if there is something that we need a specialist for, we can get them over there to take a look. So remember, just like you can go to the doctor on Monday and get a cold on Wednesday, the same thing can happen with your home inspection. Your home inspector's gonna have a contract that's gonna say don't hold them liable for things that happen later, because things will always happen later and there's no such thing as a perfect house. Even a house that was finished, new-build, yesterday. So obviously, always get a home inspection if you can. But make sure that you understand what that inspection entails. Make sure that you understand that that inspector is going to answer your questions, they're going to look out for you, they are working for you. Make sure you're comfortable with the inspector and get any specialized inspections that you need, if it's something that you're concerned with. So ideally, whenever you're buying a home, you're gonna get to have a home inspection. If you have questions about great home inspectors or buying a home in general and you want to find out more about that whole process. I'd love to talk to you. Give me a call or reach out to me here or an email and let's set up a time to chat.

Read more

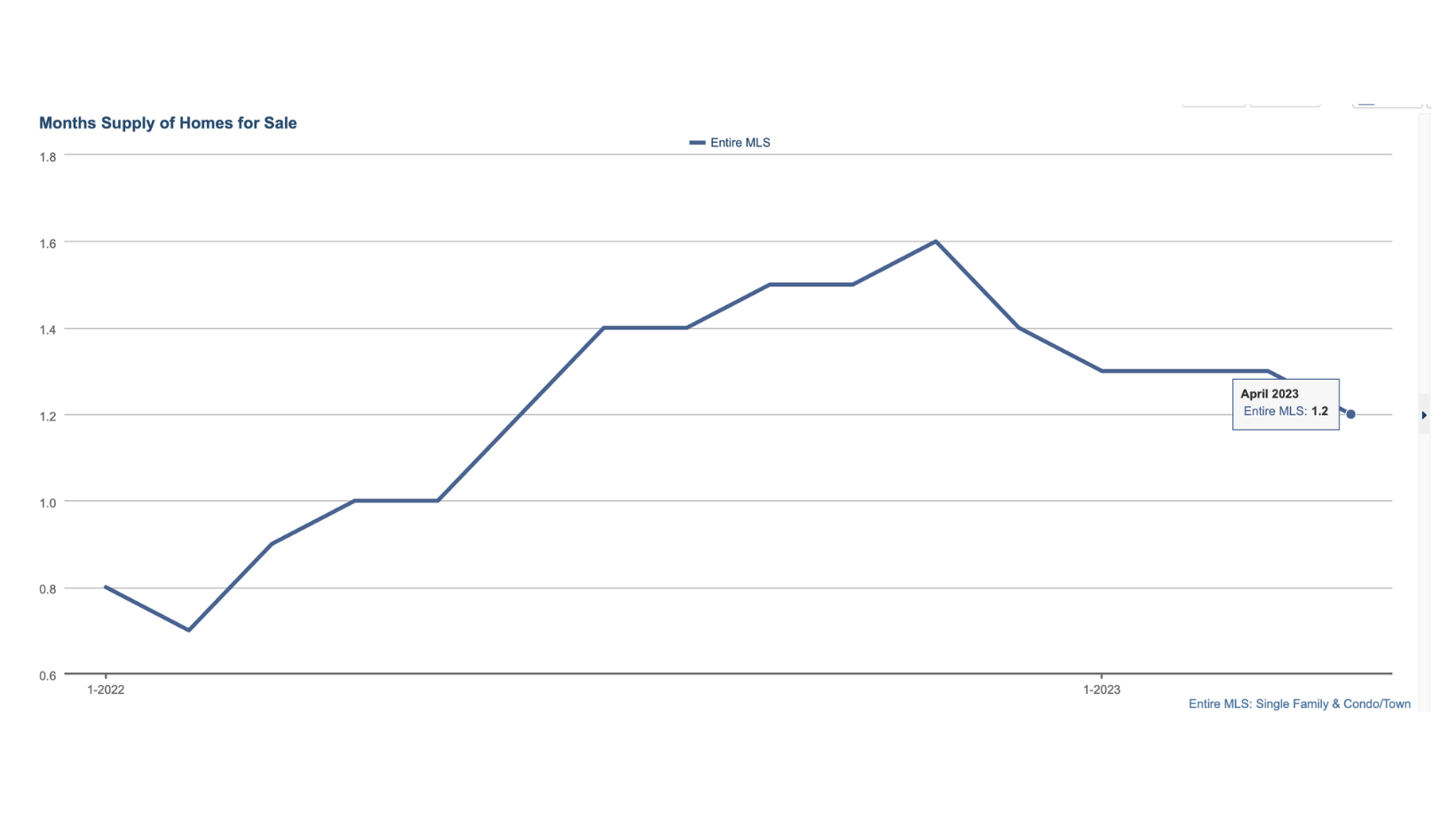

Well, spring is in full swing now, and April showers may have brought flowers, but they certainly didn't bring lots of real estate inventory. Things are still moving quickly, so here's a bit of a recap: The average sales price for our entire MLS area was $402,414 in April. That's up from $403,244 last April, and a good jump from March of this year at $386,797. The price stability and increases really are largely due to the lack of supply in the market. Rates have certainly risen since last year, but for the most part, it hasn't pushed many people out of the market. Our inventory as April closed out stood at 1933 homes for sale, down from 2203 in March, and down from 2022 in April of last year. Supply is just not where we need it to be (frankly, in either rentals or sales) and the demand is definitely out there. As I've said before, the market is considered to be balanced at 6 months supply of inventory, and while we're definitely better than we have been (February '22 had us as low as .7 month), we are still only at 1.2 months. That means that if no other homes came on the market, it would take 1.2 months for the supply to be exhausted. That's not much. What does this all mean for you if you're looking to sell? What about buying? Is it just a crazy time to do that?? These questions are both so unique to your own situation, I always hesitate saying, "it's a great/bad time to sell/buy," to a degree, regardless of the market. What I can say, though, is that if you've been contemplating selling and you thought the market was going to drop as rates went up, that hasn't proven to be true. In most areas, we are still very decidedly in a seller's market, so no doubt that it's a good time to sell. If you're thinking of buying, and it's a great time for you otherwise- new job, lease is up, new baby, new job...whatever, it's not a terrible time to buy- prices do not have the same upward pressure that they had a year ago. Yes, we're seeing multiple offer scenarios, but not every house, not every time, and often not as insane as the offers were last spring. We are seeing more inspections, more appraisals, and a bit more negotiations on some homes. But, it's not the time to drag your feet if you're looking. It's a good time to really know what your negotiables and must haves are, and work with an agent with a solid grasp on the market (like me) that will tell you what they think will get the home you want, rather than just guessing. Keep in mind, too, that there is no perfect market. If rates are lower, prices will be higher, and vice versa. It's nearly impossible to time the market, too. So if it's a good time FOR YOU, it's probably a good time. If you have questions about buying or selling in this market, reach out. I'd love to talk to you and help you determine if it's a great time for YOU.

Read more

Well, the spring weather may be popping its head up here and there, but the spring market is definitely here! If you're wondering what the market is doing here in the Richmond and surrounding areas, here's a little breakdown, piece by piece... Price- We're always hearing lots of talk about prices here, there, and everywhere. But what are prices in Central Virginia actually doing? The median home price in our entire MLS (which covers a fairly broad area) closed out at $344,900 for March '23, only a bit over $3000 higher than March of '22, and down from a high of $363,000 back in May and June of last year. The average home price was $383,036, and that's an even more narrow difference year over year. Inventory- So year over year, our prices have crept up just a bit, but maintained very well. If you're thinking, "why?? I thought the media kept saying the market was going to crash," the answer is fairly simply supply and demand. Last March, there were 2445 new listings that came on the market. This year? Only 1929. That means close to 1/3 fewer homes from which to choose, and the buying pool has not decreased by nearly that much. If you've been following real estate, or the overall economy, in the last few years, you likely know that there are simply not enough housing units (single family, condos, apartments...you name it.) to satisfy the need of people who need a home. By and large, that's because builders just stopped building, went out of business, etc, during the mortgage crisis of 2007-'08. And while the buying and renting pool has continued to increase, they've simply never caught up. Also, over the past few years when rates have been between 2.5%-3.5%, nearly everyone refinanced or bought. Most of them are not likely to put their homes on the market if they don't need to. To go from 3% to 6% is just a jump a lot of people are not interested in making. Demand- There's no way at all for us to tell how many buyers are actually in the market, per listing, but we can tell that last year this time, the "average" home was getting 16 showings before it went under contract, and this year? That number has shrunk to only 12 showings this March. That seems to indicate that there is a greater demand in the market. Okay, so, prices are stable and rising in the area...what does that mean for you if you're buying or selling? Well, if you're selling, that's a pretty easy answer. It's definitely a great time to sell. If you thought you missed the "hot" market of the last 2 years, you didn't. It's still a great time to get top dollar for your home. What has changed, though, is that in many ways, homes are costing buyers more, therefore, the buyers are not as keen to do as much as they may be in another market. In other words, making sure your home looks "ready for prime time" and is in great shape can make all the difference to get to that multiple offer situation that allows you to pick the best offer with the best terms for YOU. If you're buying? There are opportunities out there, but they are sort of few and far between. Be open to options that may not be "perfect perfect," but that allow you to add equity and value over time. Think ugly wallpaper, kitchen that needs some love, or functional bathrooms that need a makeover. Yes, those things will cost you money, but may put you in the position to have little to no competition (maybe even get a bit of a deal!), and recoup some great appreciation and possibly a better appraisal and refinance at a lower rate should rates go down later. If you're determined to buy that home that everyone wants, be prepared to compete. That means having all your proverbial ducks in a row- reapproval letter from a lender, contingency plans regarding inspection or possible repairs needed in the event you cannot have a full inspection, and the ability to be flexible on terms to appeal to some of the sellers' non monetary goals... Oh, and make sure you've got some extra intestinal fortitude, as it can be a real roller coaster ride. It is worth it in the end, though, to get a home you love! What questions about the market in your area or neighborhood can I answer for you?

Read more

It is a good time to buy? Is it a good time to sell? What's the market doing? These are just a few of the questions I always get asked as a realtor. Didn't answer your questions? Let's talk! DM me on Instagram @cindybennettrealestate or via my website at cindybennett.net.

Read more

So you want to buy a house in the new year, here are five things that you want to do now to get ready. Surprise, surprise, most of them are going to have to do with money. The first one is going to be your credit score. You can pull your credit score and your credit report all sorts of places for free. Now, you want to make sure that it's at least 620. To get a mortgage at all and at least 700 to get a good rate. Make a budget, look at what you actually spend and where you feel comfortable having your mortgage payment that may or may not be where your rent payment is now, because remember, you're going to have some extra expenses when you buy that home and it's not just the new stuff. Start saving, you definitely don't need 20% of the down payment anymore, but you are going to want to have a little bit extra in the bank to cover all of those things that might come up and closing costs. Be ready to compromise. We're going to talk about this in another video. But this doesn't have to be your forever home if it's your first home. I hope these tips were helpful. If you would like more tips, give me a follow, and if you want to put together a plan to buy a home in the new year. I'd love to help you. Give me a call.

Read more

Rates have gone up. The market is crazy. Everything's a multiple offer situation. There are so many competitive bids out there. Is it even worth trying to buy a house? There are lots of reasons like that, that I hear people say every day and I'm here to tell you that especially if you're renting, you may not want to wait until the market crashes or wait until things cooled down. Yes, rates have ticked up just a little bit, but they are still historically low. Also, if you think about the fact that a $300,000 home with 5% down, your mortgage payment is going to be somewhere around just under $1,800. If you put 5% down, your rent may be $1600, $1700, $1,800 right now. Think about it this way. That year that you're waiting for that market to cool off, you will be spending $1,600 a month paying the equity in your landlord's mortgage. Wouldn't you rather be building the equity towards your own future, paying off your own home than paying somebody else's? Also, just like home prices are going up, rental prices are going up at the same time. So, don't wait so long that you get stuck in a cycle of having to continue to pay rent while the prices continue to go up just because you're waiting for some imaginary crash. Don't wait for it. It's probably not going to happen for a really long time. If you're thinking about buying a house or just dreaming about buying a house, give me a call. Send me a message. Ask me a question. I'm happy to talk to you and I'd love to walk through whether or not it is really a good time for you to buy.

Read more- 1

- 2